Understanding the Condo Market Surge in Nassau and Suffolk Counties

Overview

Over the past year, Nassau and Suffolk counties have seen a remarkable shift in the condo market. What was once considered the “affordable alternative” to single-family homes has now become just as competitive — if not more. Condo inventory has dropped to historic lows, leaving buyers scrambling for limited opportunities. With fewer units available, bidding wars have become common, and many condos are selling at or above asking price within days of hitting the market.

This surge isn’t happening in a vacuum. It’s the direct result of a perfect storm of market forces:

- Shrinking supply as owners hold onto their units longer, waiting for top-dollar offers.

- Strong buyer demand, especially from first-time homeowners and downsizers who prefer low-maintenance living.

- Rising single-family home prices pushing more buyers toward condos as the “next best option.”

The result? Condos in Nassau and Suffolk counties are achieving record-breaking prices while staying on the market for historically short periods. For sellers, this means unparalleled leverage and the ability to maximize returns. For buyers, it means acting quickly, making aggressive offers, and often competing with multiple parties.

In short, Long Island’s condo market has become one of the hottest segments in local real estate — and understanding these dynamics is crucial whether you’re buying, selling, or investing.

Record‐Low Condo Inventory

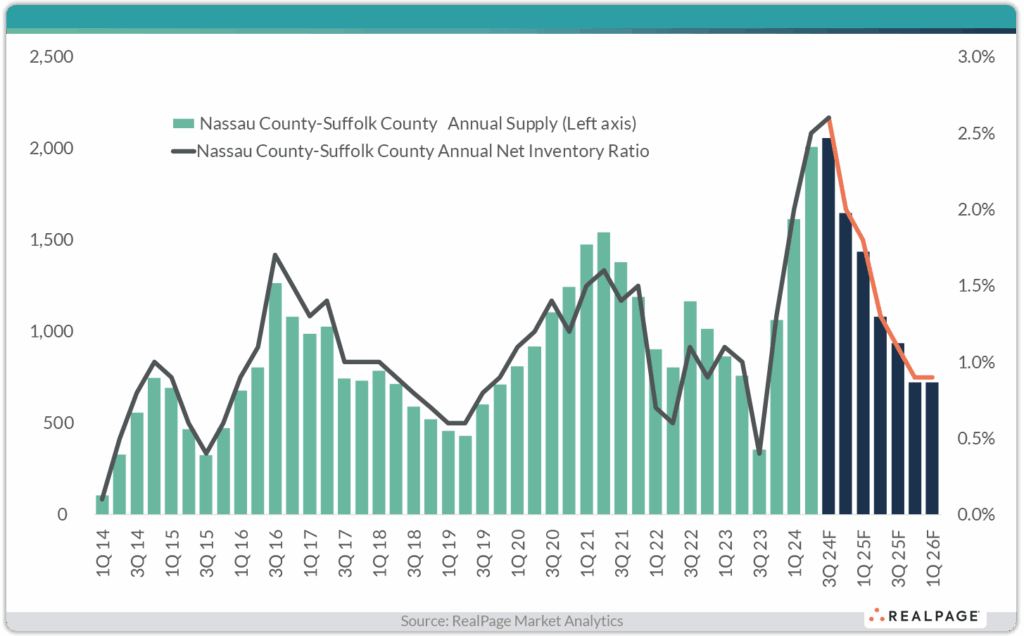

One of the defining features of today’s condo market in Nassau and Suffolk counties is the severe lack of available inventory. In the fourth quarter of 2024, listings dropped by an astonishing 34.5%, leaving just 405 condos available across both counties — the lowest level ever recorded. To put that into perspective, the region typically sees thousands of condos cycle through the market in a given year. This sharp decline represents not just a seasonal slowdown, but a structural tightening of supply that has persisted well into 2025.

So why is inventory so low? There are several key drivers:

- Homeowners Staying Put: Many condo owners are reluctant to sell, knowing they’d face today’s higher interest rates and limited options if they wanted to buy elsewhere.

- Strong Rental Demand: Some owners who might have sold are instead renting out their units, capitalizing on Long Island’s tight rental market and steady cash flow.

- Post-Pandemic Lifestyle Shifts: Downsizers, empty nesters, and retirees who once looked to sell are now holding onto their condos for the security, convenience, and community amenities they provide.

This shortage has had a ripple effect across the market. With so few condos available, each new listing attracts an outsized pool of buyers. Units that might have lingered for months just a few years ago are now being snapped up in a matter of days. In fact, multiple-offer scenarios have become the norm rather than the exception.

For buyers, this environment creates intense competition, often forcing them to stretch budgets or waive contingencies just to stay in the running. For sellers, the shortage represents an unprecedented opportunity: with demand outpacing supply so dramatically, sellers hold all the leverage in negotiations and can command record-setting prices.

In short, Nassau and Suffolk’s condo market isn’t just “tight” — it’s historically constrained, reshaping the way buyers and sellers approach every transaction.

Condo Prices Climbing Faster Than Houses

The numbers tell a clear story: condos in Nassau and Suffolk counties are selling for record prices.

In Nassau County, the median condo sale price has surged from $752,000 to $870,000, marking a 15.6% year-over-year increase. That’s not just growth — it’s acceleration. Even more striking is that condos are selling at 99.8% of asking price, which means sellers are virtually getting what they list for, with very little room for negotiation. In many cases, buyers are so motivated that they offer full price or even sweeten the deal just to beat out the competition.

Suffolk County is experiencing a similar surge, though at a slightly lower price point. Median condo prices have jumped to $537,000, up 12.5% year-over-year. What’s even more telling is that Suffolk condos are selling for 101.2% of listing price — on average, buyers are paying above asking price. This indicates bidding wars are commonplace, especially for well-maintained or ideally located units.

Looking at a full year’s worth of sales, the trend becomes even clearer:

- Nassau County: Condo prices rose 16.9% overall.

- Suffolk County: Condo prices rose 11.7% overall.

These double-digit gains highlight just how hot the condo market has become across Long Island.

To put it simply: Nassau and Suffolk condos are no longer the “entry-level” alternative to single-family homes. They are now premium assets in their own right, commanding higher prices, attracting multiple offers, and closing fast. For sellers, this is the most profitable environment in years. For buyers, it means navigating a fiercely competitive landscape where hesitation often results in losing out.

With Nassau condos now averaging around $870,000 and Suffolk holding strong at $537,000, both counties have set new records — and unless inventory loosens up, the upward pressure on prices is likely to continue.

Broader Housing Market Trends

While condos are grabbing headlines for their explosive appreciation, single-family homes in Nassau and Suffolk counties are also experiencing significant gains.

In Nassau County, the median home price climbed to $860,000 in July 2025, representing a 6.8% year-over-year increase. Just a month earlier, in June, the median price was $850,000, up 6.3% compared to the previous year. These consistent gains highlight a steady and robust demand for suburban living, especially in a county known for its strong schools, proximity to New York City, and well-established communities.

Suffolk County is seeing parallel growth, though at a slightly more affordable level. For the first time ever, Suffolk’s median home price broke the $700,000 threshold, reaching $702,000 in July 2025. Back in June, the county’s median price was $700,000 flat, which still represented a 5.3% increase year-over-year. This milestone underscores how Suffolk — traditionally the more affordable of the two counties — is catching up to Nassau as buyers look further east for value, space, and lifestyle.

Inventory Still Strained

Even with these price gains, the story of Long Island’s housing market remains the same: too many buyers chasing too few homes. In June 2025, there were 6,232 listings across Nassau and Suffolk combined — up 14.6% from April, but still about 5% lower than the same period last year. While this increase provided some short-term relief, it is nowhere near enough to keep up with demand.

For context, a healthy housing market typically balances at around six months of supply. On Long Island, the available inventory is often closer to two months or less, meaning that properties are turning over rapidly, with many going under contract within a matter of weeks.

What It Means for Buyers and Sellers

- Buyers: Competition remains fierce, with limited leverage to negotiate. Many are being pushed east into Suffolk or considering condos as an alternative to single-family homes.

- Sellers: Conditions remain highly favorable, with multiple-offer scenarios and strong sale-to-list ratios. Even as mortgage rates remain elevated, demand has not subsided enough to cool prices.

The takeaway? Both condos and single-family homes are surging in tandem, driven by historically low inventory and steady demand. Whether you’re in Nassau or Suffolk, today’s market strongly favors sellers while continuing to challenge buyers to act quickly and decisively.

Market Forces at Play

Both the condo and single-family housing markets in Nassau and Suffolk are suffering from the same issue: too little inventory to meet demand. Condos are feeling the crunch most acutely, but single-family homes are not far behind. In both cases, the imbalance has created a marketplace where buyers are routinely offering above asking price just to secure a deal.

Speed of Sales

The speed at which properties are selling underscores just how hot the market has become:

- Single-family homes are going under contract in an average of 21 days — about three weeks from listing to accepted offer.

- Condos, surprisingly, aren’t lingering much longer. Depending on location and condition, they are selling within 38–47 days, a brisk pace considering condos historically sat longer than detached homes.

This turnaround time is remarkable when compared to more balanced markets, where 60–90 days on market is considered normal. Today, hesitation often means losing out, as properties are being snatched up almost as soon as they’re listed.

Bidding Wars and Seller Advantage

In such a competitive environment, bidding wars are becoming the rule rather than the exception. Buyers, recognizing the scarcity of options, are coming to the table prepared to:

- Waive inspection or financing contingencies.

- Increase down payments to strengthen offers.

- Outbid rivals by tens of thousands of dollars, especially on updated or well-located condos.

For sellers, this dynamic translates to unmatched leverage. Not only are they fielding multiple offers, but they are often in a position to choose the strongest terms, not just the highest price — cash deals, quick closings, or buyers willing to take the property “as-is.”

The Bigger Picture

This climate of fast sales and escalating offers is a double-edged sword. Sellers enjoy record-breaking returns, but buyers face mounting pressure, with affordability becoming a growing concern. For investors, the pace of appreciation is attractive, but entry into the market has never been more competitive.

In short, Nassau and Suffolk’s real estate market has evolved into a seller’s paradise. As long as inventory remains at historically low levels, rapid appreciation and bidding wars are likely to remain a defining feature of both the condo and single-family segments.