Are you a real estate investor in Suffolk and Nassau County seeking to optimize your property investments while minimizing tax liabilities? A 1031 Exchange could be the strategic tool you’ve been looking for. Let’s dive into the details of this tax-deferral strategy and explore how it can benefit your real estate endeavors in these vibrant New York counties.

What is a 1031 Exchange? A 1031 Exchange, also known as a like-kind exchange or a tax-deferred exchange, is a powerful legal provision under the Internal Revenue Code. It enables real estate investors to defer capital gains taxes when selling a property and reinvesting the proceeds into another property of equal or greater value. This mechanism allows you to preserve your investment capital and potentially grow your real estate portfolio more effectively.

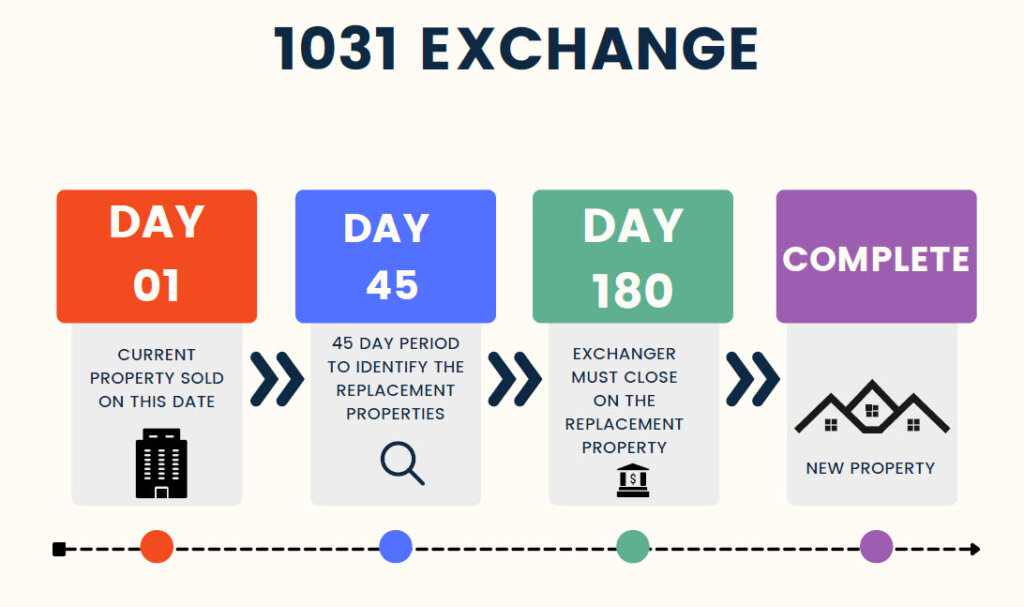

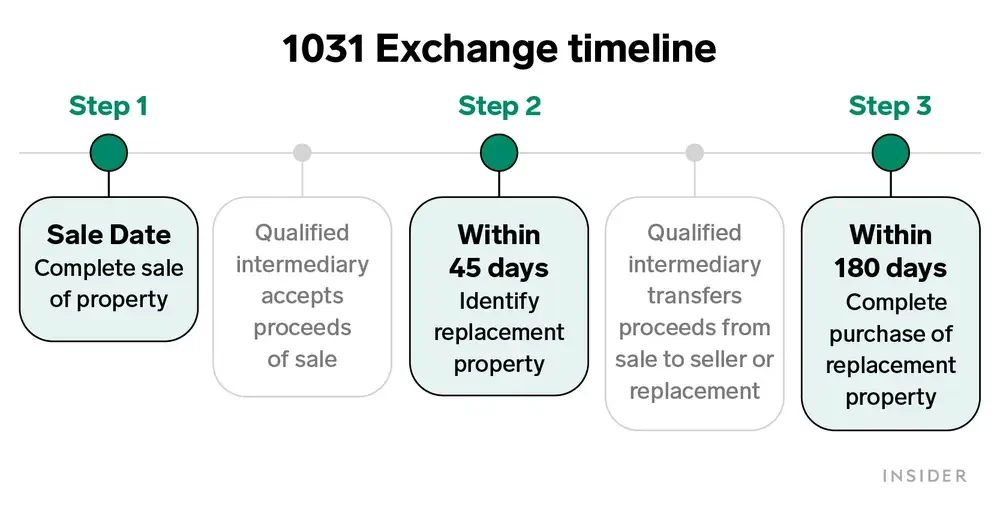

How Does It Work? When you sell a property and reinvest the proceeds into another qualifying property within a specific timeframe, the capital gains taxes that would typically be due are deferred. This means you can leverage the entire sales amount to acquire a new property without immediately paying taxes on the gain.

Key Benefits for Investors:

- Preserve Capital: By deferring taxes, you have more funds available to reinvest, enhancing your purchasing power and potential for portfolio growth.

- Diversification: The flexibility to exchange properties across different asset types and locations allows you to diversify your investments to match your goals and market trends.

- Wealth Accumulation: Over time, strategic 1031 Exchanges can lead to significant wealth accumulation due to the compounding growth of deferred taxes.

- Tax Savings: By continually exchanging properties, you can potentially defer taxes indefinitely, creating substantial tax savings over the long term.

- Estate Planning: Utilizing 1031 Exchanges can be a valuable estate planning tool, allowing you to pass on a larger portion of your real estate wealth to future generations.

Navigating the Process: A successful 1031 Exchange involves adhering to strict rules and timelines. It’s crucial to work with experienced professionals who can guide you through the complexities of identifying replacement properties, meeting deadlines, and ensuring compliance with IRS regulations.

Why Suffolk and Nassau County? Suffolk and Nassau County offer a diverse range of real estate investment opportunities, from residential properties to commercial ventures. The region’s vibrant economy, proximity to New York City, and robust market make it an attractive location for real estate investors seeking growth potential and stability.

Partnering with Experts: Navigating a 1031 Exchange requires expertise in both real estate and tax regulations. At Realty Evolution, we specialize in guiding investors through this intricate process. Our team of experienced professionals understands the unique dynamics of the Suffolk and Nassau County markets, helping you identify suitable replacement properties that align with your investment objectives.

Unlock the tax benefits of a 1031 Exchange while capitalizing on the potential of Suffolk and Nassau County’s real estate landscape. Contact Matthew Klages today to explore how we can help you strategically optimize your investments and achieve your financial goals.

How Can We Help You?

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.